Seller Financing in Business Acquisitions Buyers often request Seller financing in business acquisitions as part of

How to Negotiate a Commercial Lease Negotiating a commercial lease is a critical step when buying

By Paul Long 7/3/2024 The SBA recently unveiled a pilot program designed to address a critical

Weekly SBA stories, news, & tips from two industry experts for the SBA lending industry (Click

Buying a business is a significant undertaking that requires careful consideration and being strategic when making

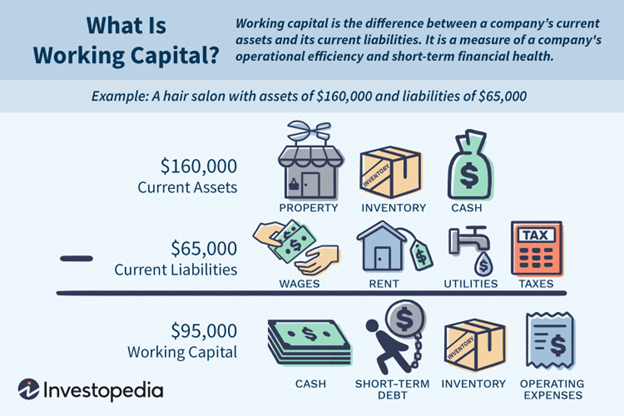

I need a loan and I have no idea what the banker is looking for!” Well

Since the week after his 16th birthday, Paul Long has been in the banking industry. After

https://willtalksbiz.com/2023/03/15/your-guide-to-sba-loans/ “The lending process is a mystery, but I’m here to peel back the onion and

11/10/2022 CLICK HERE TO LISTEN Today’s guest on this Scale Your Small Business episode is Paul

It was my pleasure to be on South Sound Copnnection Podcast. I am talking about Creating