By Paul Long 7/3/2024

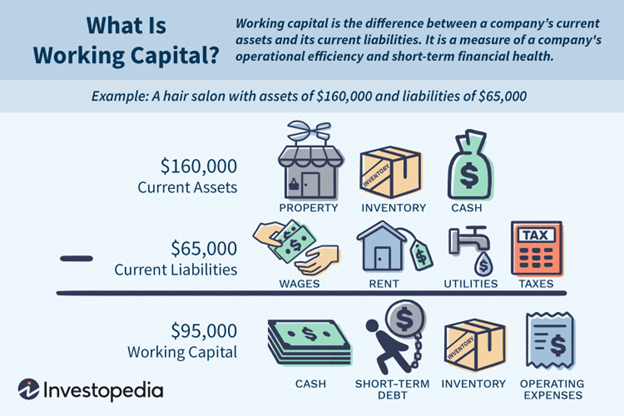

The SBA recently unveiled a pilot program designed to address a critical need for many small businesses, getting access to working capital. The new Working Capital Program (WCP) aims to provide easier access to funds for businesses struggling with cash flow, supporting growth and resilience.

All businesses face tight cash flow during their ownership. Daily expenses can outpace incoming revenue due to inflation or unexpected expenses. This can hinder the businesses’ ability to make payroll or pay vendors. The SBA WCP addresses this challenge by offering government-backed credit lines of up to $5 million.

As of the date of this article the current SBA loan programs include SBA Express Lines of Credit which are up to $500,000 and the Working Capital CapLine which goes up to $5 Million but lenders are nervous out this program due to the requirements placed by the SBA.

Here are the features of this new program:

- Flexibility: A flexible annual SBA upfront guaranty fee. This allows businesses to customize the loan to their specific needs and reduces the cost of borrowing for shorter-term financing.

- Focus on Assets: The program is categorized as an Asset-Based Working Capital Loan. This means businesses can leverage their existing assets, like inventory or receivables, as collateral to secure the loan.

- Supporting Export and Domestic Sales: Unlike some existing programs, the WCP caters to both domestic and international sales under one facility.

- Currently an export line of credit can only be used for exporting.

- Home Energy Rebate Program Tie-In: For companies involved in the Inflation Reduction Act’s Home Energy Rebate Programs, the WCP offers an additional solution. It can help them scale up their capacity and mobilize services to meet the program’s demands.

Pilot Program and Next Steps

The WCP is currently in its pilot phase, with the official launch happening later in 2024. The SBA is finalizing program details, which will be available on their website. Lenders like Gesa Credit Union will participate in this new program.

Comments are closed